Small business loans can be essential for business growth, but navigating the lending process can be challenging. One way to simplify the process is by working with an SBA loan broker. These professionals help small business owners find the right loan options and guide them through the application process. In this guide, we’ll walk you through the steps to secure an SBA loan broker for your business and maximize your chances of approval.

What Is an SBA Loan Broker?

An SBA loan broker is a professional who specializes in connecting small businesses with lenders that offer Small Business Administration (SBA) loans. These brokers have extensive industry knowledge and access to a wide network of lenders, making it easier for business owners to secure financing that aligns with their needs.

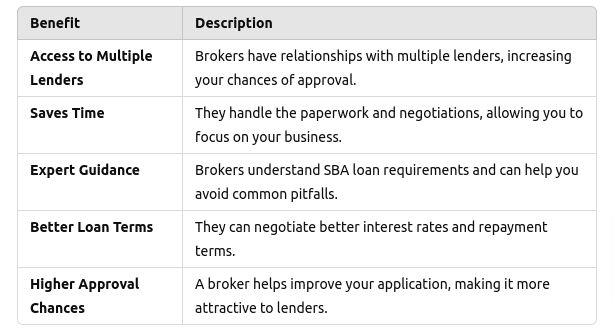

Benefits of Using an SBA Loan Broker

Working with an SBA loan broker can provide several advantages:

Understanding SBA Loans

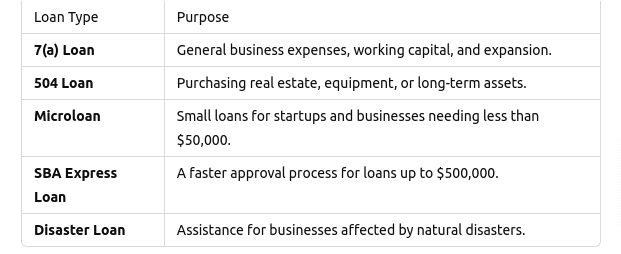

SBA loans are government-backed loans designed to support small businesses. The SBA does not directly lend money; instead, it guarantees a portion of the loan provided by approved lenders. This guarantee reduces lender risk, making it easier for small businesses to qualify.

Using a business loan calculator can help you estimate your repayment amounts and compare different SBA loan options.

Steps to Secure an SBA Loan Broker

1. Understand Your Small Business Loan Needs

Before looking for a broker, determine why you need a loan and how much funding you require. Consider factors such as:

- Working capital needs

- Equipment or real estate purchases

- Expansion plans

- Emergency expenses

By identifying your financial goals, you can choose the right SBA loan type and discuss it with your broker.

2. Research SBA Loan Brokers

Finding a reliable SBA loan broker is crucial to securing the best financing option. Consider these factors when researching brokers:

- Experience: Look for brokers who specialize in small business loans and have a track record of successful approvals.

- Reputation: Read client reviews and testimonials to gauge their credibility.

- Transparency: Ensure they have a clear fee structure, as some brokers charge a percentage of the loan amount.

- Lender Network: A good broker should have strong relationships with multiple lenders.

3. Verify Broker Credentials

To protect yourself from scams and unreliable brokers, verify their credentials:

- Check if they are registered with the National Association of Government Guaranteed Lenders (NAGGL).

- Ask for references from past clients.

- Confirm their certifications and professional affiliations.

4. Compare Loan Offers

Once you’ve chosen a broker, they will present multiple loan options. Compare these offers based on:

Factor | Consideration |

Interest Rate | Lower rates mean lower overall costs. |

Loan Term | Longer terms may have lower monthly payments but higher overall interest. |

Fees | Check for origination fees, prepayment penalties, and broker fees. |

Repayment Schedule | Ensure the repayment schedule aligns with your business cash flow. |

Using a business loan calculator can help you analyze different loan structures and choose the best option.

5. Prepare a Strong Loan Application

Your SBA loan broker will help you put together a strong application. To increase your chances of approval, ensure you have the following documents:

- A detailed business plan outlining your goals, revenue projections, and loan usage.

- Personal and business tax returns from the past two years.

- A profit and loss statement showing your financial performance.

- A personal financial statement to assess your financial health.

- Collateral details (if required), such as property or equipment.

A well-prepared application speeds up the approval process and minimizes the risk of rejection.

6. Negotiate Loan Terms

Your broker will negotiate the loan terms on your behalf, ensuring you get the best possible deal. Key aspects to negotiate include:

- Interest rates

- Repayment period

- Fees and penalties

- Loan covenants (restrictions placed by the lender)

By working with an experienced SBA loan broker, you can secure more favorable terms than applying alone.

7. Review and Sign the Loan Agreement

Before signing the loan agreement, carefully review the terms and conditions. Pay attention to:

- Repayment schedule

- Any hidden fees or clauses

- The total cost of the loan

Ask your broker to clarify any doubts before proceeding.

8. Receive Funding and Manage Your Loan

Once approved, you’ll receive the funds in your business account. To ensure financial stability:

- Use the funds for their intended purpose.

- Make timely payments to avoid penalties and damage to your credit.

- Track your loan payments using a business loan calculator to stay on top of your finances.

Common Mistakes to Avoid When Using an SBA Loan Broker

- Not verifying the broker’s credentials: Always check their background before proceeding.

- Ignoring hidden fees: Some brokers charge high fees; clarify all costs upfront.

- Relying on one loan offer: Always compare multiple loan options before making a decision.

- Failing to prepare financial documents: A poorly prepared application can delay approval or lead to rejection.

- Not using a business loan calculator: Miscalculating your repayment amounts can create financial stress.

Conclusion

Securing an SBA loan broker can simplify the loan application process and increase your chances of getting approved for small business loans. By following the steps outlined in this guide, you can find a reliable broker, compare loan offers, and secure funding that supports your business growth.

Always use tools like a business loan calculator to make informed financial decisions and manage your loan effectively. With the right broker and careful planning, you can obtain the financing needed to take your business to the next level.