Whether or not you’re asking your self “what is that this cost on my bank card?” or analyzing your spending and rewards incomes, bank card statements characteristic a wealth of data past the monitor document of your bills.

Making it a behavior to assessment your assertion might help you keep on monitor together with your monetary objectives. Let’s check out what a typical card assertion contains.

What’s a bank card assertion?

Your bank card assertion is a month-to-month doc that itemizes your spending over the previous billing cycle and shows utilized fees in addition to different details about your credit score account. As soon as a month, your card issuer sends it by mail or via paperless strategies through your bank card firm’s on-line portal.

Reviewing your bank card statements every month may deliver extra consciousness to your debt balances, provide you with a warning to any errors or fraudulent exercise, inform you of account modifications and allow you to discover spending developments. Federal regulation requires issuers to ship your assertion at the very least 21 days earlier than your fee due date, however it is best to be capable to discover new and historic statements via your financial institution’s web site or app no matter whether or not you select the paper or paperless choice.

Nonetheless, to actually profit from reviewing your bank card assertion, it’s important to know learn how to learn it. Let’s break down a real-life bank card assertion so you may higher perceive your individual.

Your bank card assertion: An instance

Account abstract

EXPAND

Your account abstract is among the important sections in your bank card invoice and supplies a quick define of the place your account stands. Consider it like a recap of what’s occurred over the previous billing cycle. You’ll see vital data together with —

- Earlier assertion stability

- Complete funds obtained

- Any assertion credit

- Utilized charges

- Curiosity fees

- Complete purchases

- Accessible credit score

- Money advances

Something that affected your general assertion stability will get totaled up right here. Merely put, your assertion stability is the sum of all the costs, credit and funds made to your bank card account throughout that particular billing cycle. You’ll see any assertion credit — like reward redemptions or refunds — and funds deducted out of your stability whereas purchases, curiosity fees, charges and money advances get added to it.

This part can even present your credit score restrict and the accessible credit score in your account so you understand how shut you might be to your credit score restrict, which lets you determine your credit score utilization.

Have in mind

Your account abstract contains solely these transactions that got here in earlier than the shut of your billing cycle — not these charged after. Which means you would be seeing fees from weeks in the past. You assertion reveals your assertion stability, not your present stability. On-line banking nonetheless, makes it extra handy to view your latest exercise everytime you need.

Cost data

EXPAND

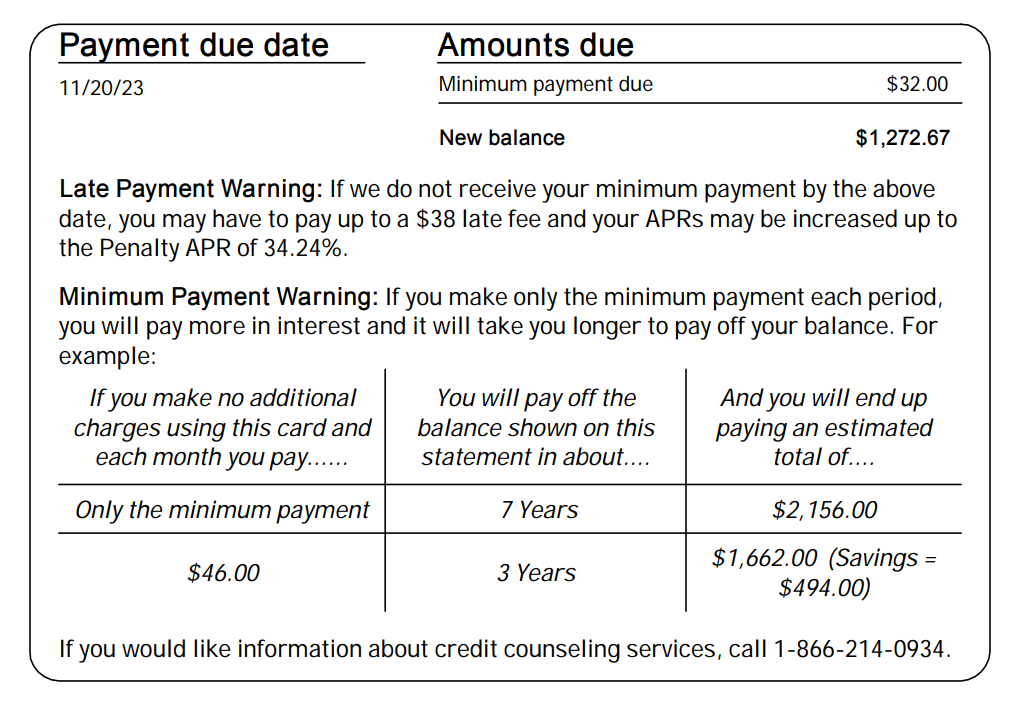

Your fee data part supplies your excellent stability and the minimal fee required to keep away from late charges or a penalty APR. You’ll additionally discover the date your fee is due, so mark your calendar if you happen to haven’t already arrange computerized funds.

Minimal fee warning

In accordance with amendments to the Fact in Lending Act, you’ll see a minimal fee warning within the fee data part cautioning you in regards to the penalties of solely making minimal funds in your bank card stability. That is paired with calculations for a way a lot money and time you’ll save if you happen to improve your month-to-month fee.

Bank card suppliers are required by regulation to offer you an concept of what you’d have to pay monthly — with no further purchases — to repay the stability in three years, typically expressed as 36 months.

Included with the minimal fee warning could also be a credit score counseling discover, supplied that will help you join with a nonprofit credit score counseling company. In the event you’re having bother making your minimal funds, short-term points can usually be solved with a cellphone name or electronic mail to your credit score issuer — however some circumstances require further assist to start out getting debt below management.

See Bankrate’s minimal fee calculator for a personalized technique to manage your funds, with the power to enter your stability, charge, minimal fee quantity and different figures to assist decide your supreme fee plan.

Late fee warning

Even if you happen to’ve made each bank card fee on time, you’ll nonetheless see a late fee warning on every bank card assertion. Paying lower than the minimal requirement or lacking the fee due date will result in a late payment and probably a spiked rate of interest that are each outlined within the late fee warning.

EXPAND

In the event you miss a bank card fee, name your issuer and attempt to submit at the very least the minimal as quickly as you may. In the event you’re 60 days overdue, it’s sometimes when a penalty rate of interest kicks in. Your delinquent fee may additionally be reported to the key credit score bureaus — Equifax, Experian and TransUnion — leading to a success to your credit score rating.

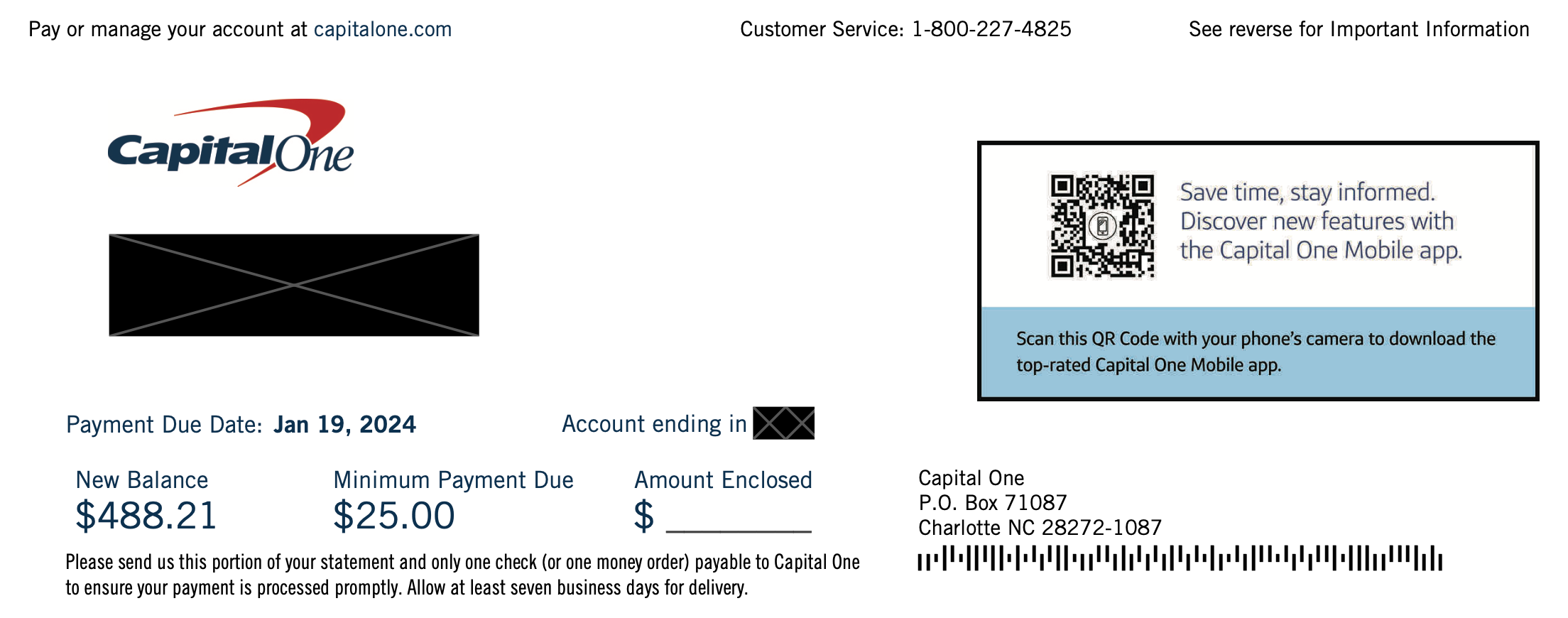

Cost coupon

EXPAND

In the event you obtain your bank card statements within the mail, it features a fee coupon so that you can submit together with a examine or cash order. A helpful technique to keep away from the mail whereas avoiding late funds is thru your bank card’s autopay, which automates your funds every month. If autopay doesn’t work to your funds, you may all the time schedule a fee via the net platform or cellular banking app forward of your due date.

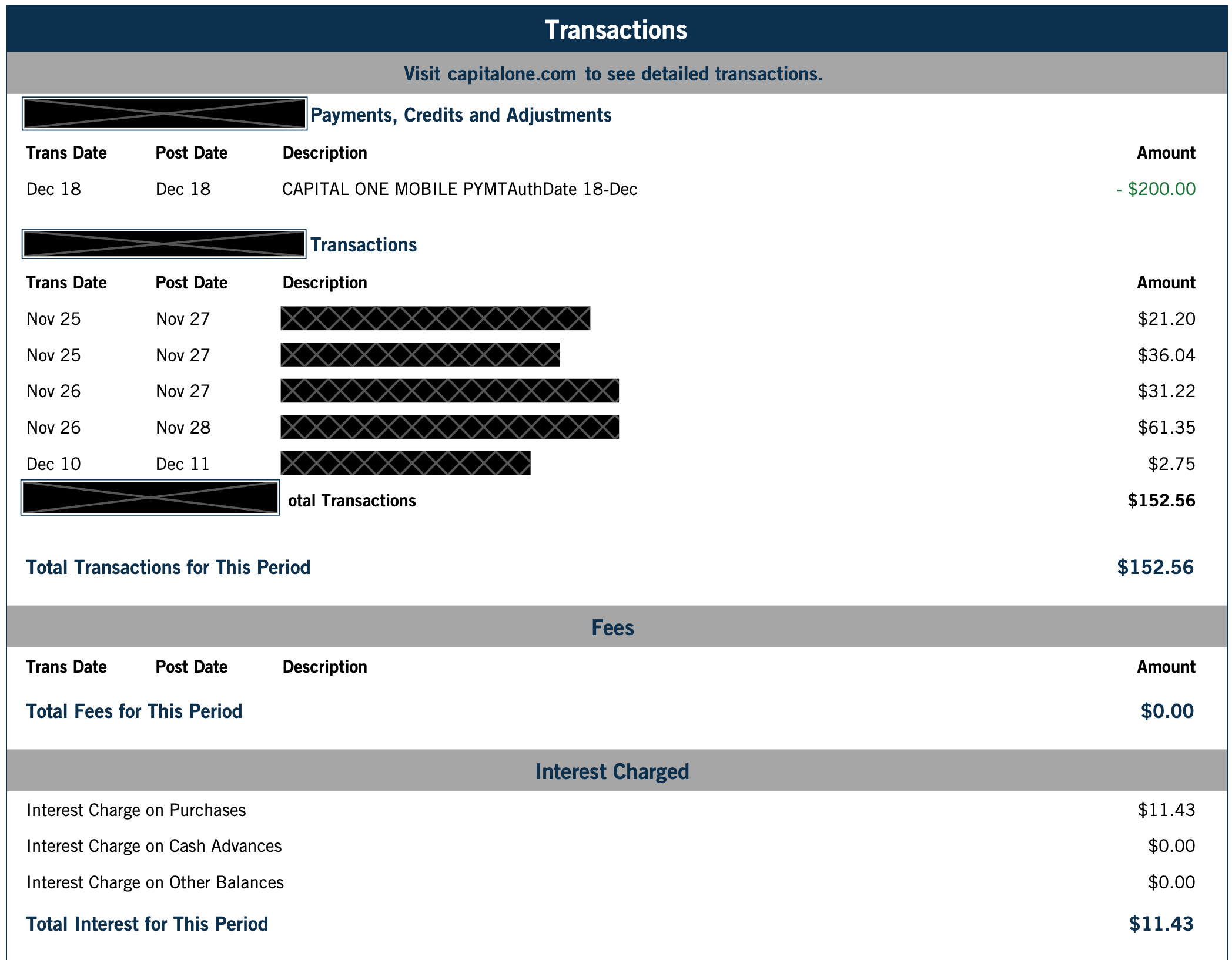

Transactions from the billing interval

EXPAND

That is probably essentially the most helpful part in your bank card assertion. Your transactions part itemizes all the purchases, fees, assertion credit and funds you’ve made throughout the billing cycle. Every line reveals the next details about the posted transactions:

- Transaction date

- Date the transaction was posted

- Location and identify of the service provider

- Reference quantity

- Final 4 digits of the cardboard used

- Quantity charged or credited

When you have licensed customers in your account, the final 4 digits of the cardboard used may allow you to determine the place or who the acquisition stemmed from. In the event you use cellular wallets, you would possibly see a be aware like “Digital Card,” slightly than your final 4 digits.

Most significantly, this breakdown reveals the quantity charged for each transaction made, which is a should when checking for discrepancies. Noticing developments in your month-to-month fees can also be one of many quickest methods to find the place you may lower bills. Plus, it offers perception into your highest or frequent spending classes, which might help you analyze whether or not you’re utilizing the precise rewards card to your spending.

In the event you see a suspicious cost or one you didn’t authorize, name your issuer instantly. Many card issuers provide zero-liability fraud safety if you happen to report the costs inside 30 days.

Complete curiosity and costs year-to-date

EXPAND

Your assertion features a abstract of the curiosity and different charges you paid within the present 12 months, together with annual charges. Most charges are avoidable if you realize the methods round them. This may also be a useful metric when deciding when it’s time to do a stability switch, change to a decrease payment card or use a debt consolidation mortgage.

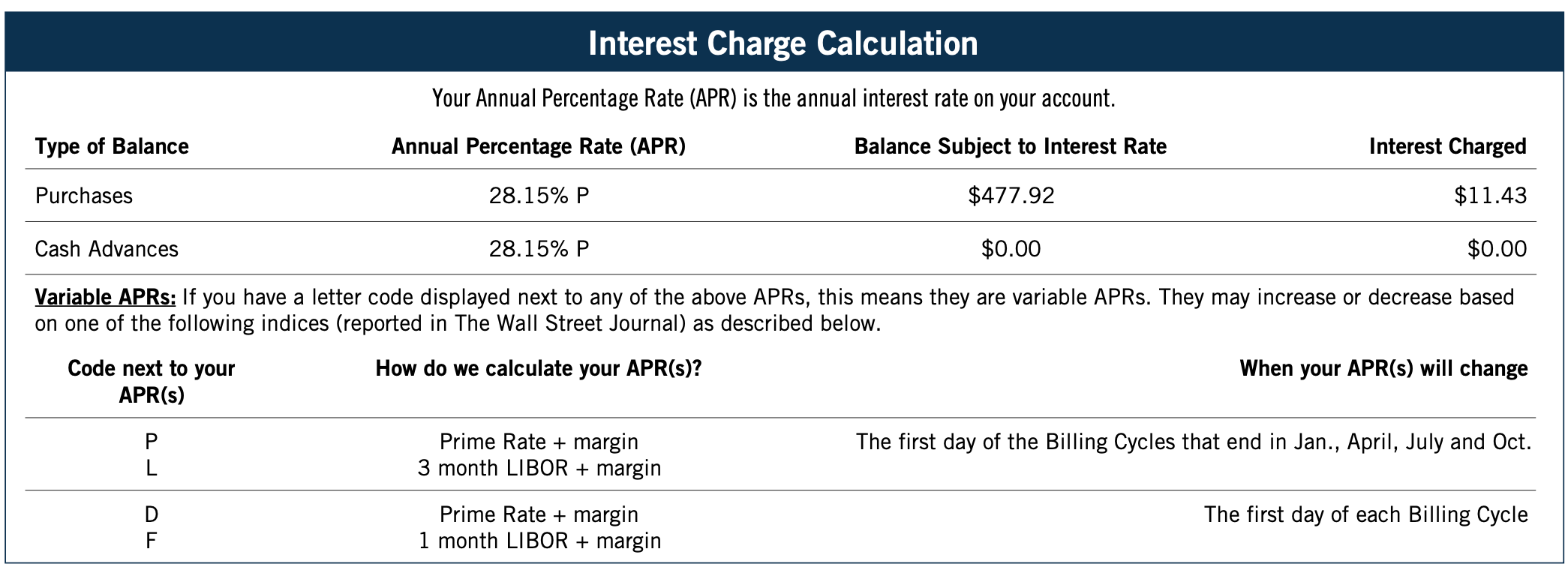

Curiosity cost calculation

EXPAND

Close to the underside of your assertion you’ll see an curiosity cost calculation which incorporates the APR for each purchases and money advances. These two rates of interest are sometimes totally different with the money advance charge sometimes set greater, however they are often the identical relying on the bank card issuer. You’ll seemingly discover you might have a variable rate of interest — that means it might probably change — which is customary for bank cards.

This curiosity cost calculation can even define the particular occasions when the APR is about to vary relying on how your account is coded. It outlines how your APR is calculated which is the sum of two or extra of those components:

Test this part whenever you wish to know the standing of any promotional or introductory APR interval, if you happen to’re contemplating a money advance or whenever you’re thinking about executing a stability switch.

Essential messages

EXPAND

Your bank card assertion might embrace an vital messages part or account notices part which is supposed to provide you with a warning to any modifications made throughout the billing interval. Which may embrace any modifications you requested, comparable to a credit score restrict improve or a change to a distinct card sort.

With some banks, modifications to your account are depicted in numerous sections.Typically, a shift within the annual payment or your rate of interest could also be present in an “Account Adjustments Notification” part slightly than right here. Your credit score issuer is required by regulation to tell you of all of those modifications, however it could take some further scouring of the doc to search out it.

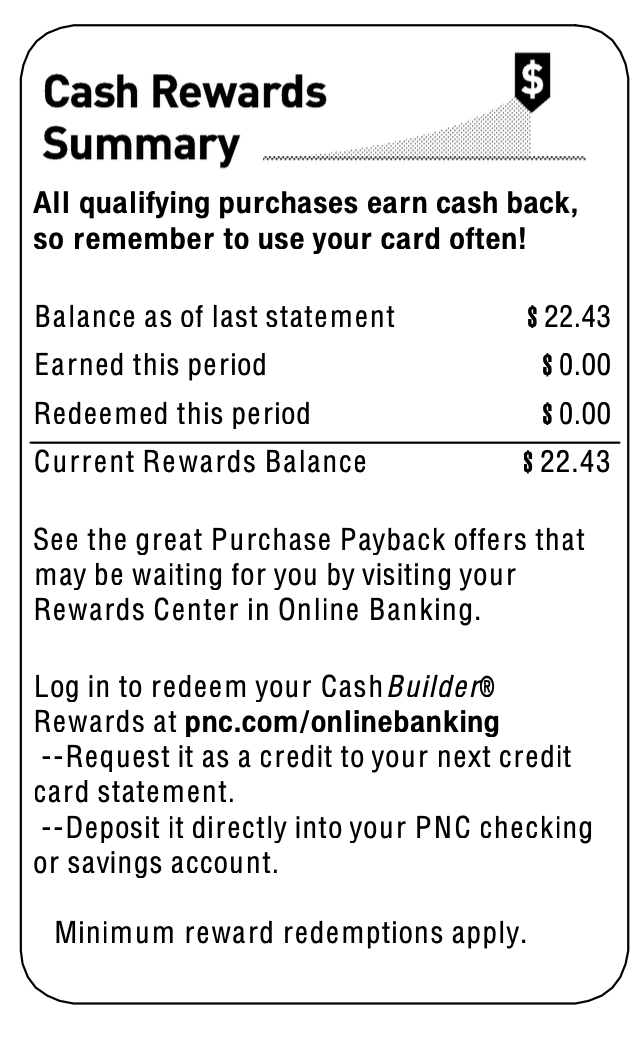

Rewards abstract

EXPAND

In the event you’re enrolled in a rewards program, you’ll discover an outline of the place you stand on the finish of your assertion. Some statements are extra inclusive than others, however usually one can find the factors, money or miles you’ve earned throughout the billing cycle and the entire rewards quantity accessible.

While you wish to plan your subsequent trip, cowl a giant buy or simply repay your assertion stability with a press release credit score, protecting monitor of those rewards may allow you to attain these objectives quicker.

How lengthy do you have to maintain bank card statements?

Most specialists suggest protecting paper bank card statements for 60 days. That’s the standard window most bank card firms give clients to report errors on their statements, although some provide longer durations. Nevertheless, it is likely to be extra advantageous to go paperless as an alternative.

Most bank card firms help you maintain and entry your bank card statements via their on-line banking platform for at the very least a 12 months. Capital One, for instance, shops on-line statements for as much as seven years. So there are three important methods you will get your bank card statements:

- Checking your mailbox each month

- Logging in to your on-line bank card account

- Logging in to your bank card’s cellular app

Sometimes you’ll get an electronic mail every month when your assertion is prepared and you may entry it securely by logging into your account. In the event you can’t handle to search out considered one of your statements on-line, you would additionally name in to your card issuer’s customer support line and request a replica of the assertion you want.

That’s notably useful if you’ll want to maintain monitor of your bank card exercise for tax functions like proudly owning a small enterprise or making charitable donations. In these instances, you would possibly want entry to your statements for as much as six years, within the occasion that you simply’re audited.

Whilst you would possibly benefit from the comfort of getting paper statements available, on-line statements are simply as accessible, have the identical data, and will prevent a couple of hours of sorting via stacks of paperwork.

The underside line

Understanding learn how to learn your bank card assertion helps you preserve management over your funds. Whether or not you select to maintain a papertrail with mailed statements or entry them on-line, you’ll discover the statements helpful in managing your bank card account.

Reviewing your bank card assertion every month is among the finest methods to examine for errors, see your rewards, analyze your spending and learn how a lot curiosity and costs you’re being charged. If a assessment of your assertion reveals excessive curiosity fees or rewards that don’t match your spending habits, chances are you’ll wish to think about switching to considered one of at the moment’s finest bank cards as an alternative.