Key takeaways

- A secured mortgage requires you to pledge collateral — one thing of worth like a financial savings account or automotive.

- When you default, a lender can seize the collateral to fulfill the debt.

- Secured loans typically have greater mortgage quantities and decrease charges than unsecured loans.

Loans are a option to finance a wide range of prices, they usually are available in two types — secured and unsecured. In brief, secured loans require collateral whereas unsecured loans don’t.

You’ll additionally discover that secured loans are usually simpler to qualify for and have decrease rates of interest as they pose much less threat to the lender. Nonetheless, they will not be the most suitable choice for you and will have critical penalties in your credit score and funds for those who can not repay what you borrow.

What a secured mortgage is and the way it works

Secured loans are debt merchandise which can be protected by collateral. Because of this once you apply for a secured mortgage, the lender might want to know which of your belongings you intend to make use of to again the mortgage.

The lender will place a lien on that asset till the mortgage is repaid in full. When you default on the mortgage, the lender can declare the collateral and promote it to recoup the loss. It is very important know exactly what you’re promising and what you stand to lose earlier than you are taking out a secured mortgage.

Execs and cons of secured loans

Secured loans provide many benefits, like usually giant borrowing limits, however in addition they have some dangers.

Execs

- Bigger borrowing limits. Secured loans typically have greater most mortgage quantities than unsecured loans.

- Decrease common charges. Lenders usually provide decrease charges for secured loans than unsecured ones.

Cons

- Threat of shedding collateral. A lender can seize the collateral used to safe the mortgage for those who default.

- Potential lack of flexibility. Some secured loans can solely be used for its supposed goal.

Secured mortgage vs. unsecured mortgage

Some loans, equivalent to private loans, could be both unsecured or secured, relying on the lender. When you don’t qualify for the unsecured possibility otherwise you’re on the lookout for the bottom doable rate of interest, examine if the lender gives a secured mortgage possibility.

When selecting a secured versus an unsecured mortgage, there are a number of elements to contemplate. Listed here are a number of key variations between the 2.

| Secured mortgage | Unsecured mortgage | |

|---|---|---|

| Availability | Will need to have an asset to make use of as collateral | Collateral not required |

| Borrowing limits | Greater borrowing limits for those who’re placing up collateral of equal or larger worth | Decrease borrowing limits that will not be adequate in your funding wants |

| Credit score rating | Credit score rating and monetary well being will decide eligibility, however they could possibly be extra accessible you probably have very bad credit | Credit score rating and monetary well being will decide eligibility, and also you typically want good or glorious credit score to qualify for probably the most aggressive mortgage phrases |

| Eligibility standards | Much less stringent for the reason that lender assumes decrease threat | Extra stringent for the reason that lender has no rights to the collateral for those who default on the mortgage |

| Rates of interest | Sometimes decrease | Sometimes greater |

| Penalties | Collateral could be seized, credit score rating will drop | Missed funds will enter into collections, credit score rating will drop |

| Mortgage varieties | Mortgages, HELOCs, auto loans, enterprise and secured bank cards, and many others. | Unsecured bank cards, pupil loans, private loans, and many others. |

Kinds of secured loans

There are a lot of varieties of secured loans. 5 of the commonest embrace:

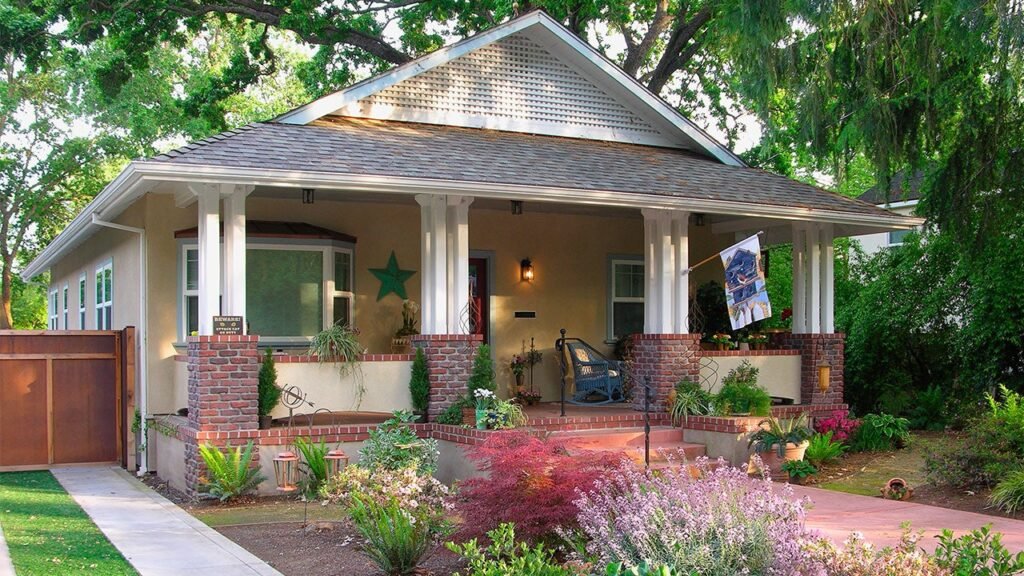

- Mortgage: With a mortgage, you set your own home or property up as collateral to purchase that house. When you fail to make the funds, your own home could be foreclosed on.

- House fairness line of credit score: A house fairness line of credit score (HELOC) provides you entry to your own home fairness within the type of a credit score line, which is considerably just like a bank card. With a HELOC, you additionally put your own home up as collateral.

- Auto loans: When taking out a mortgage to pay for a automotive or every other car, your car will typically be used as collateral. When you don’t make the funds on time and in full, your car could possibly be seized.

- Mortgage for land: A land mortgage is used to finance the acquisition of land. Such a mortgage makes use of the land itself as collateral.

- Enterprise mortgage: A secured enterprise mortgage can be utilized to purchase tools, pay wages or spend money on enterprise tasks. There are a variety of issues you should utilize as collateral, together with stock, tools or your land or constructing.

Kinds of collateral used

What you utilize as collateral possible will rely on whether or not your mortgage is for private or enterprise use. Some examples of collateral embrace:

- Actual property, together with fairness in your house.

- Money accounts (retirement accounts usually don’t qualify).

- Vehicles or different autos.

- Equipment and tools.

- Investments.

- Insurance coverage insurance policies.

- Valuables and collectibles.

Secured loans and default

After a number of missed funds on a secured mortgage, the lender will possible repossess the asset used to safe the mortgage. And repossession isn’t the top of the matter. If the repossessed asset doesn’t promote for sufficient to cowl the quantity of your mortgage, you’re liable for the distinction.

For instance, for those who owe $20,000 once you cease making funds on a ship mortgage and the boat is repossessed and offered for $15,000, you’ll owe the lender the excellent $5,000 and any excellent charges. The default stays in your credit score report for seven years from the primary cost you missed.

When you miss funds on a mortgage, house fairness mortgage or enterprise mortgage, the lender has a lengthier course of to recoup its cash. In about half the U.S. states, a lender should go to court docket to foreclose on a property. Within the different half, the lender should give you advance discover of foreclosures.

What to do for those who can’t repay a secured mortgage

When you’re having problem repaying a secured mortgage, there are a number of steps you’ll be able to take.

- Contact the lender. Contact your lender to debate your choices. The lender might agree to change your mortgage phrases, together with a brand new cost schedule, new reimbursement time period or briefly pause funds through mortgage deferment.

- Search monetary assist. You possibly can attain out to a client credit score counseling company licensed by the Nationwide Basis for Credit score Counseling (NFCC) or the Monetary Counseling Affiliation of America (FCAA). Additionally, contemplate talking with the U.S. Division of Housing and City Growth-approved housing counselor that will help you negotiate mortgage modification phrases along with your mortgage supplier.

- Prioritize your payments. Concentrate on paying those which have probably the most critical penalties for nonpayment. For instance, making your own home mortgage cost might take precedence over paying your bank card invoice.